VALUE PROPOSITION

Why Forte – What separates CSG + Forte from our competitors? Experience, Technology and Focus Specifically related to Billing and Payments Excellence!

Explore the various features of Forte’s Next-gen payment platform – DEX, offering a complete merchant and partner experience in retail, mail order and ecommerce verticals.

Why Forte – What separates CSG + Forte from our competitors? Experience, Technology and Focus Specifically related to Billing and Payments Excellence!

BUILT FOR SCALE & STABILITY.

Performance | Innovation | Forward-thinking | Trust

The Strawhecker Group (TSG) informs & guides the world’s leading payment players, from fintech startups to Fortune 500 companies including, JPMorgan, FIS and Elavon. Forte has partnered with TSG since mid year 2020, subscribing to their Gateway Enterprise Metrics (GEM) platform. TSG’s Gateway Enterprise Metrics (GEM) is the only platform in the payments market that provides unique looks to merchant, developer, and gateway performance perspectives.

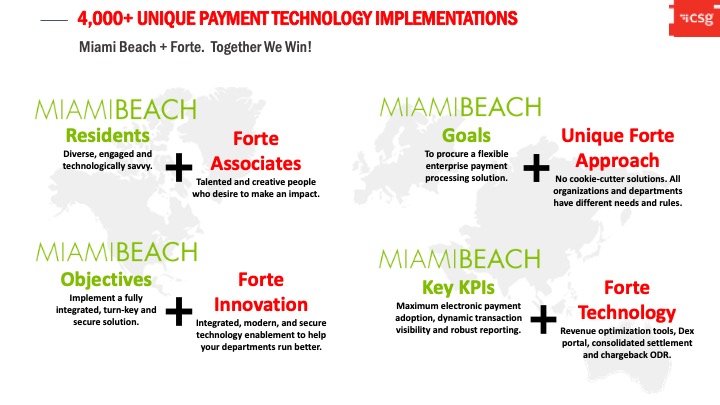

THE POWER OF PARTNERSHIP

An approach and methodology built specifically for Government

Any Payment / Any Channel / Anytime! Forte’s Payments Platform as a Service allows Miami Beach the ability to leverage one platform that does it all.

Kiosk Tablet with POS terminal setup, Bill Search and Checkout

Standard kiosk designs that can accommodate a wide array of configurations

Complete Payments Solution

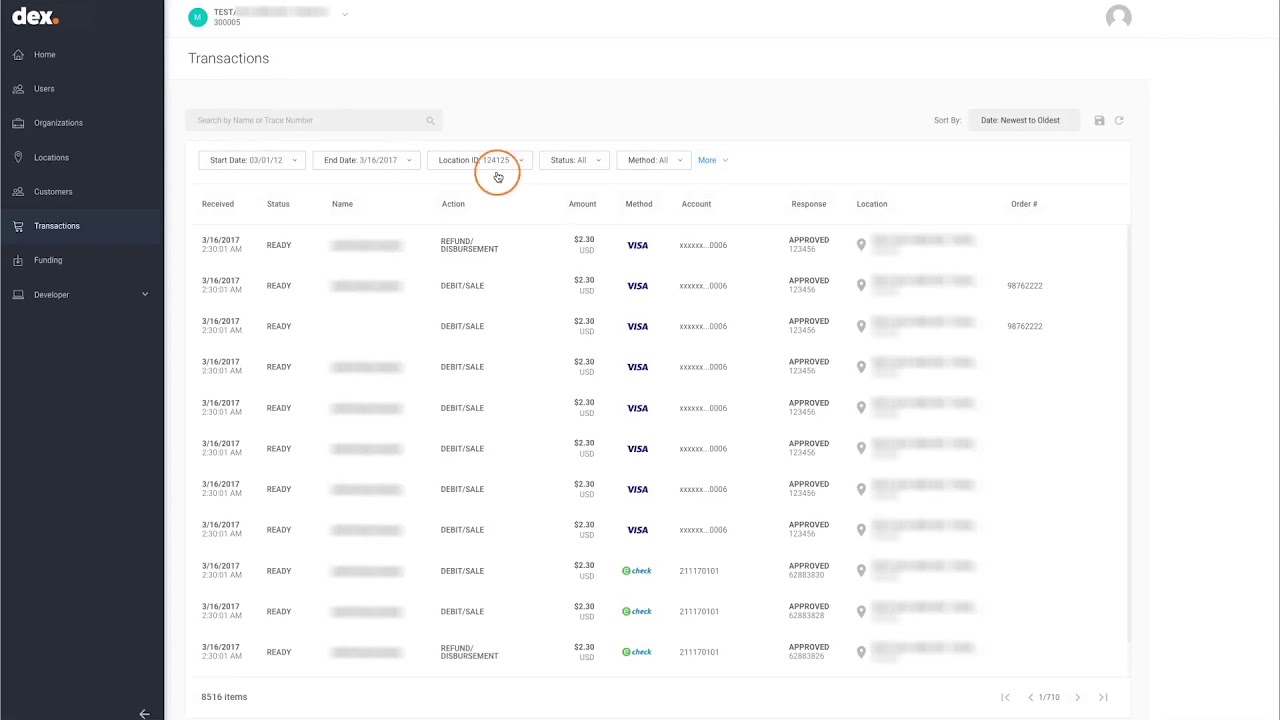

Explore the various features of Forte’s Next-gen payment platform offering a complete merchant and partner experience in retail, mail order and ecommerce verticals.

Merchants can perform four different types of credit card transactions from the Transactions Datagrid. Additionally, merchants can choose to save the customer data from a transaction or perform a one-off transaction without saving customer data.

The Funding Datagrid enables users with the appropriate permissions to view the funding entries of an organization’s locations. By default, Dex displays the funding entries for the previous thirty days, but you can filter the displayed results by Effective Date, Bank Account Number, Amount, Funding Source and/or Funding Status.

The self serve reporting module allows merchants to generate reporting on transaction and funding activities for a given time frame. Merchants with the appropriate permissions can also export transactions to a .csv file that can then be stored on a local computer or imported into an accounting application for processing.

Start here to learn the basics of navigating Dex.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut in fringilla odio, vitae dictum ex. Ut ut bibendum ante

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut in fringilla odio, vitae dictum ex.

Explore key features of DEX in an engaging interactive format

A token is a unique string ID that references stored customer information or a customer’s stored payment information (such as a credit card or an echeck). Tokens provide customers convenient, secure access to their billing, shipping, and payment information, making the checkout process faster and easier. For merchants, tokens provide a convenient method of collecting scheduled recurring payments.

Together, We Win! CSG is uniquely positioned in the marketplace, bringing together the Power of Print/Mail, Conversational AI, Customer Engagement Solutions, and Experiences Practices Teams that embed payment capability. We are committed to driving excellence with expectations that our approach will change the industry.

Velosimo provides off-the-shelf technology connectors built specifically for government agencies. They support agencies that require technology development assistance, in particular, for back-end solutions that have limited integration options. The Forte / Velosimo partnership allows agencies to continue using their current software systems (iNovah, Tyler, ePlan, etc) in a fully integrated manner with CSG Forte payments by leveraging Velosimo’s “connector” as a data integration adapter. This allows the City to select the best-in-class payment processing without sacrificing precious data automation and workflow.

Velosimo is not a part of CSG Forte. Velosimo is a technology company that focuses solely on integrating disparate and often competitive systems; effectively serving as a data integration “Switzerland.” So, it is important that Velosimo maintains independence from the companies it works closely with for integrations. CSG Forte has an established a partnership with Velosimo to help solve payment integration gaps that occasionally plague our customers.

As a direct acquirer CSG Forte provides an online chargeback dispute management module that allows merchants to track, respond, and upload documentation. By digitizing this process and providing highly visible tracking tools our customers can be timelier and more accurate in responding to chargebacks; and this helps increase the probability of a chargeback being reinstated on behalf of the merchant. CSG Forte also does not immediately initiate callbacks. We allow the chargeback process to reach resolution. If a chargeback is not reinstated, we provide notice to our customers prior to initiating the recovery of funds. Alternatively, when CSG Forte operates as a gateway chargeback disputes must follow the process of the direct acquirer that is being used. Although the merchants that require a gateway will still have access to our online tools for reporting, research, and gathering of the needed information to respond to a chargeback through the acquirer established process.

CSG Forte’s settlement occurs on the second business day after the transaction is made. So, for example, if a payment is made on a Monday the funds would hit the City’s account on Wednesday. Additionally, credit card settlements are consolidated across all card types in one deposit and eCheck settlements are consolidated in another deposit. When CSG Forte serves as a gateway the acquiring processor will determine the settlement process, not CSF Forte.

Unfortunately, and like several other payment processors in the government merchant processing industry, Tyler Technologies has been steadfast in its strategic direction to limit payment integrations to BridgePay and OpenEdge. This is despite several large government merchants lobbying with Tyler to allow and support integrations with their preferred payment processing partners. That said, Forte does maintain a grandfathered integration with Tyler Munis.